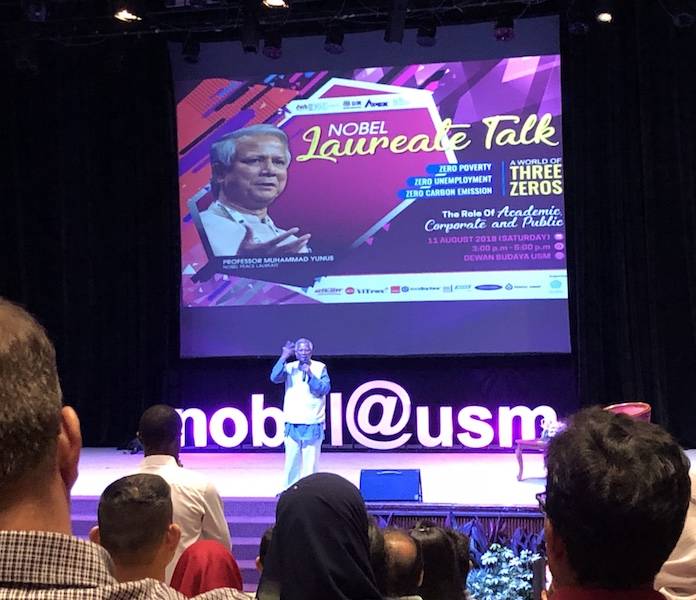

A World of Three Zeros by Professor Muhammad Yunus, Nobel Peace Laureate at Dewan Budaya, Universiti Sains Malaysia, 11 August 2018.

Attended a captivating talk today by Prof. Yunus on his effort in eradicating poverty, unemployment and carbon emission in the world. I simply love the way he thinks. Brilliant at shifting the mindset of the mass or ‘standards’ set by the general public. Shifting one ‘thought brick’ at a time. His ideas are simple yet effective. He’s good at telling jokes too–especially poking fun at bankers and current practices.

Prof. Yunus started off by saying that he wanted to be useful to the world, outside the university. He went to villages to find out what he could offer. After seeing the realities of the outside world, he felt all the courses, classes in economics were useless. For example, there was no mention of loan sharks in economic courses, yet the rural poor were using the ‘services’ of loan sharks. To the eyes of bankers, the poor are ‘credit-unworthy’. Prof. Yunus argued that the bankers are ‘people-unworthy’. Thus, due to the prevailing ‘people-unworthy’ banking practices, the poor had to resort to the loan sharks for a small amount of loan to start a business.

Then, Prof. Yunus had a brilliant spark. He wanted to feel useful to the village people. What if he starts offering a small loan? In the beginning people asked him whether is he another loan shark? (Very funny!) Eventually he managed to convince some rural people, and that snowballed into several hundreds and thousands. For rural people, a small loan of USD30 means a lot. For instance, a small loan is enough to buy a few chickens for eggs. The eggs can be sold and after certain months, the small loan can be paid with interest. Then the whole micro-finance cycle starts again. And he set the target to offer 50% of these small loans or micro-credits to women.

But why women? some bankers asked… To this, Prof. Yunus retorted, why men? In many traditional banking practices, loans are provided to practically men. Astonishingly, only 1% were lent to women (in Bangladesh, I think). He set to change the practices for Grameen Bank.

To meet the 50% women lenders, interestingly, Prof. Yunus had to overcome some challenges. He had to convince women to take the money (the micro-credits). According to him, money is typically handled or own by husbands. Wives hardly felt they were good enough to deal with money. They would rather remain ‘invisible’ than to take the risk of managing money. Overcoming these deeply ingrained perceptions, it took him 6 years to reach the target of 50%.

Later the 50% target was abolished; the percentage of micro-loans taken by women soared to 97%.

Prof. Yunus also explained the concept of a social business. A social business is a business created and sustained to solve a social problem and runs to cover the cost. A social business is a business with profits for others; as opposed to a business, which aims to bring profits for self. A social business is selfless. He added the ‘profits for self‘ is the underlying assumption of capitalism.

To this end, Prof. Yunus established Grameen Bank, the bank for the poor, a noble effort to help reverse the unhealthy socioeconomic imbalances and poverty in the society by providing micro-loans for small businesses. That’s the first Zero. The second Zero is directed for the children of his earlier borrowers – they were university graduates who complained of lack of job opportunities. Interestingly, Prof. Yunus was accused for ‘creating unemployment problems/conditions’. Brilliantly, he reversed the mindset by saying we are entrepreneurs at birth; never a job-seeker. So he challenged the university graduates to learn to create small businesses – just like their mothers did 2-3 decades earlier. For the final Zero, Prof. Yunus shared his effort venturing into energy, solar energy specifically, for rural communities by Grameen Shakti.

Prof. Yunus acknowledged USM and Malaysia where Amanah Ikhtiar Malaysia started. And where it opened the door for his micro-finance system to get replicated in other countries and scaled up around the world. Before he ended his talk, he puts out recommendations on laying some kind of boundary for technological advances–between a blessing and a curse. Citing the news of AI-written short fiction that nearly won a literary award, he believed that unwarranted technological advances can do more harm than good to human civilisation. With that message, he concluded his inspiring talk on a World with three Zeros: poverty, unemployment and carbon emission.

A brief analysis of the presentation

Overall a huge enterprise for the others, explained in simple laypeople’s language by Prof. Muhammad Yunus. Before I came to his talk, I thought it is going to be dry. I was wrong, as mentioned earlier – Prof. Yunus seemed to enjoy poking fun at bankers (and burst their bubbles). It’s a talk by an economist who is successful in offering ‘his kind of social business model’* to solve socio-economic issues involving the banking/micro-finance systems that anyone can relate to and understand. He started with a personal statement i.e. he wanted to be useful to the villagers.

This is exactly what a presenter with strong academic backgrounds should aspire for. Humble, gentle and affable, Prof. Yunus talked for almost 70 minutes with zero slides (his fourth Zeros;-)) He used simple English. He spoke calmly with clarity. No macro- or micro-economics jargons was used. And he enthralled the entire 400-strong crowd with his stories and intelligent humour. Prof. Yunus’ talk reminds me of Sir Ken Robinson’s TED Talk, can schools kill creativity?

I love going to presentations and study speakers. And learn from them… perhaps ‘learn‘ is a better word than ‘study’ (Hahaha…). Tomorrow I plan to attend a morning dialogue session with Prof. Yunus at Penang Science Cluster and learn more from him.

If there is one message of Prof. Yunus that resonates so strongly with me… it’s when he said,

The village became my university

Thanks for sharing. As though I have attended the talk!

Great to hear that, Dr Nasuha=) Thank you!

Thank you Dr Nik!

Love!